The charts below depict the 11 BSAs and the performance of the post-BSA occurrence trading periods for a second version of the Bull Vix (BVX) algorithm which was developed for integration into the BBT algorithm. The new version was developed to significantly reduce the number of post BSA trading periods to enable the BBT algorithm to maximize its performance. After a BSA (Bullish Sentiment Anomaly) has occurred the BBT defaults to the BVX’s signals until the post BSA occurrence trading period has concluded.

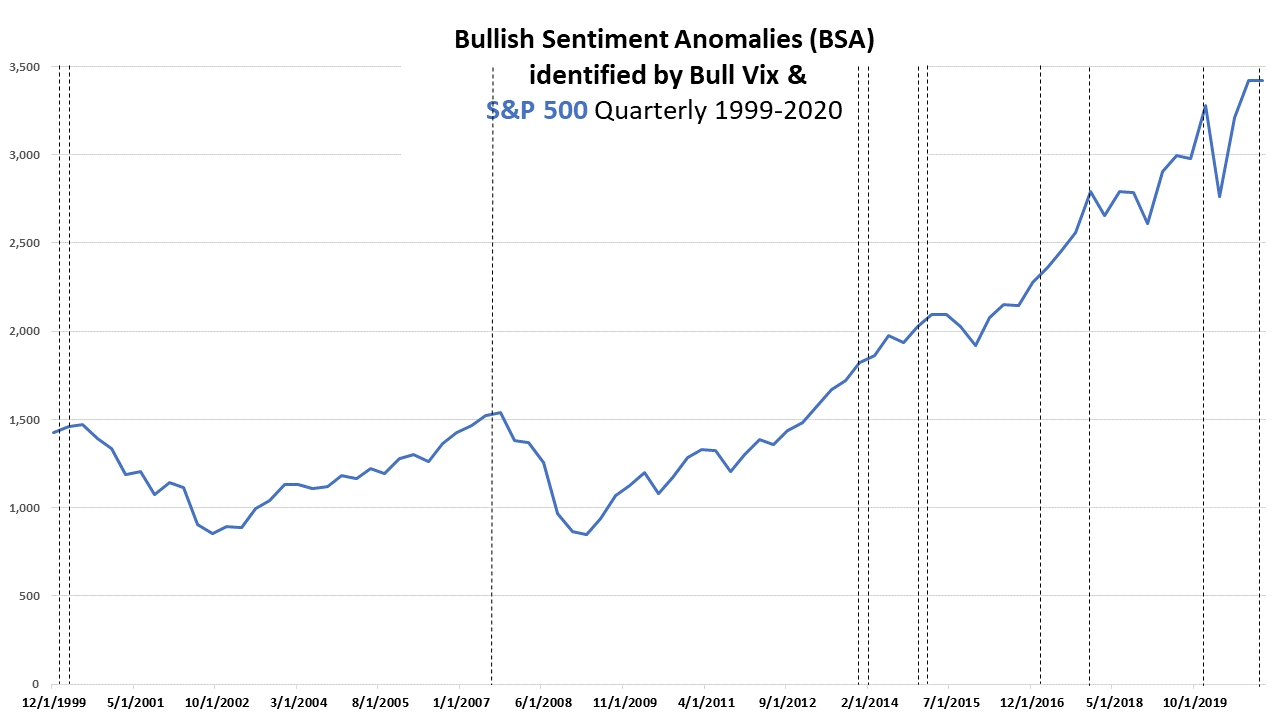

The BVX/BBT version monitors for BSAs which exclusively occur at record highs. According to the BVX/BBT there were 11 BSAs for the 20 years ending 2020 including the 11th which occurred on 12/4/2020. The most recent BVX (non BBT) subscriber version which was unveiled on December 20, 2020, had 16 BSA occurrences for the 10 years ended 2020 since it monitors for BSAs which occur at multi-year highs.

Note. There is no difference in the instructions and alerts which Bull Vix subscribers are receiving since the BVX/BBT alerts are a microcosm of all BVX alerts. The good news is that additional empirical research findings which will soon be published will reveal that the current BSA trading period has the potential to produce returns that are higher than all of the prior post BSA occurrence trading periods.

The chart below contains the S&P 500’s quarterly prices and the 11 BSAs which occurred from 1999 through 2020. The chart depicts that the S&P 500 declined significantly after BSAs occurred in 1999/2000, 2007, 2015, 2017/2018 and 2020.

The Bull Vix’s nine gains and one loss for its alerts to trade the CBOE Volatility Index (VIX) after the Bull Vix’s 10 post-BSA occurrence trading periods through January of 2020 are depicted in the chart below.

For the Bull Vix to produce gains for the three BSA trading periods in which the S&P 500 increased required the utilization of an averaging down and averaging up trading strategy. To execute the strategy requires that a 50% stake be maintained at all-times.

Two important things to know about the CBOE Volatility Index (VIX) and the shares of the VXX and UVXY which mimic and trade the VIX:

- Since the VIX is an index, it and the VXX UVYX shares which trade it are not stocks and thus can-not go to ZERO.

- When the correction does occur the VIX has the potential to spike immediately to produce triple-digit gains as depicted in the chart below.

To increase the potential for profits from trading the VIX and its related securities requires:

- The VIX, etc., being traded only after a BSA has occurred.

- Maintenance of 50% stake until the Bull Vix trading period has ended.

- Willingness to take losses when the Bull Vix instructs to shift from a 100% to a 50% stake.

Throughout my 43 years in the markets, the VIX is the only index/security that I root for to go down after the initial 50% stake have been recommended. The significant volatility for the VIX and the VXX and UVXY shares which mimic and trade the VIX throughout the minimum five-week post BSA occurrence trading period can be utilized to average down. The Bull Vix’s alerts can also be used to increase profits from selling 50% of the stake at a profit and then buying back in at lower prices.

Finally, be on standby to read the newest breakthrough research findings mentioned above. The two reports will soon be published.

SubscribeTo BullVIX

The BullVIX Algorithm Exclusively:

- Monitors for Bullish Sentiment Anomaly (BSA)

- Recommends UVXY, VXX shares & call options that mimic CBOE volatility index (VIX) increases after a BSA occurrence

Since a Bullish Sentiment Anomaly (BSA) is a rarity with an average duration of 5-weeks, Bull Vix only offers ONE-TIME PAYMENT subscription offerings